Asset Finance Broker Sunshine Coast & Mackay - Loans for cars, boats, equipment

Asset Finance

Sunshine Coast & Mackay Asset Finance for personal or business loans such as car loans, equipment loans, boat finance & more.

Why do all the hard work finding a lender when QE Loans on the Sunshine Coast and in Mackay do it for you, with expert lending knowledge at no extra cost to you?

Find me the right loan (for free!)

Asset Finance

Sunshine Coast & Mackay Asset Finance for personal or business loans such as car loans, equipment loans, boat finance & more.

Find me the right loan

Asset Finance Solutions - Australia Wide

Where ever you’re situated in Australia, speak to the expert finance brokers at QE Loans for great lending solutions.

Any kind of asset finance, we've got you covered.

Car Loans

Sunshine Coast & Mackay

Car loans can be personal or business finance, purchase or lease in a range of formats. Talk to QE Loans about the right option for you.

Boat Loans

Sunshine Coast & Mackay

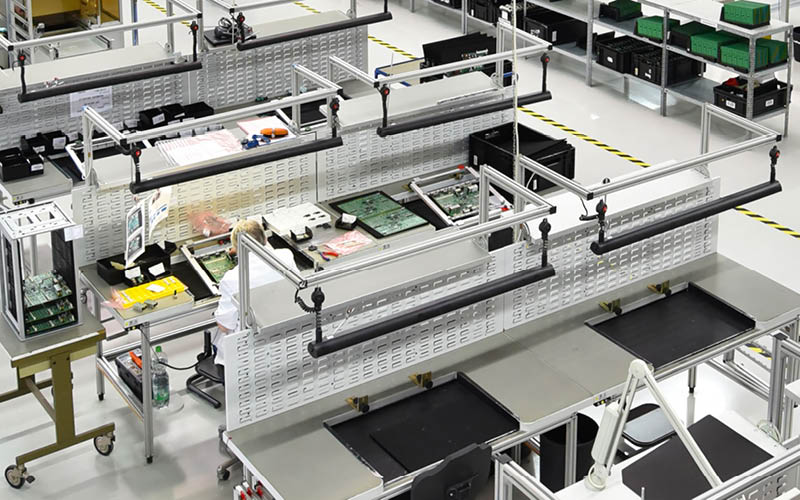

Heavy Equipment Loans

Sunshine Coast & Mackay

Truck / Transport

Equipment Finance

Sunshine Coast & Mackay

From a single truck to a nationwide fleet, QE Loans on the Sunshine Coast & Mackay will find the right finance / loan solution to suit your business needs.

Mining Equipment

Finance

Sunshine Coast & Mackay

For major investments such as mining equipment, it is vitally important to have every aspect of the financing solution expertly guided.

Business Equipment

Finance

Sunshine Coast & Mackay

Business equipment can be anything from manufacturing machinery, to computer equipment, to gym equipment or anything else. Talk to QE Loans today.

Caravan Finance

Sunshine Coast & Mackay

There are a range of loan solutions for caravans, from basic loans to using the equity in your home to refinance. Talk to QE Loans about the options available to you.

Farm Equipment Loans

Sunshine Coast & Mackay

What ever farming equipment you need, QE Loans on the Sunshine Coast & Mackay are here to help you obtain the best possible finance solution.

Any Asset Finance

Sunshine Coast & Mackay

There are so many different assets people need funding for… we couldn’t possibly list them all. What ever you need, QE Loans are here to help you get the best finance.

… and much more. What ever asset you need finance for, talk to QE loans on the Sunshine Coast and in Mackay for friendly, expert advice.

Understand the various loan / finance options

Do you know which kind of finance is best for you? Let us explain the pros and cons of each, then guide you in the right direction.

Chattel Mortgage

If you are a businesses acquiring vehicles and equipment, a chattel mortgage allows you as the the borrower to purchase the asset upfront while the financier holds a mortgage over the asset as security.

Some of the key aspects of a chattel mortgage are:

• Choose to have repayments scheduled over a duration that suits your needs (generally 2 to 5 years).

• Interest rates tend to be lower compared to unsecured loans and can either be fixed or variable.

• Repayments can either be consistent each month or tailored to accommodate your seasonal cash flow (if on a fixed rate).

• Your balance sheet immediately reflects ownership of the financed asset, along with the financing as a liability.

• Optionally, a balloon or residual payment can be arranged at the term’s conclusion to reduce monthly payments.

Lease

The lender purchases the vehicle or equipment of your choosing, then leases it to you for the agreed term. Upon the lease’s conclusion, you have the option to buy the asset from the lender or return it. If the asset generates income, your business can typically deduct the lease payments.

Pros:

• We acquire the asset per your request and lease it to you for a specified term

• Use the asset as your own throughout the lease period

• Your business can usually deduct lease payments as a tax expense.

Cons:

• Ownership of the asset remains with the lender.

• Modifications to the asset are restricted since ownership isn’t yours

• At lease end, returning the asset and paying residual value is required

Novated Lease

A novated lease (commonly referred to as salary sacrificing) is suitable for employees. The arrangement involves the employee, their employer and a finance company. The employee selects the vehicle, the finance company purchases it, then leases it to the employee. The employer then deducts lease payments from the employee’s pre-tax salary.

Pros:

• Tax benefits: Payments made from pre-tax salary, reduce the taxable income

• Full freedom of vehicle selection

• Convenience as employers typically handle admin tasks such as payments

Cons:

• Exiting the lease early due to job changes or other circumstances can incur financial penalties.

• While the employer covers lease payments, the employee is responsible for ongoing running costs such as maintenance, fuel, and insurance

• The employee doesn’t own the vehicle during the lease term, limiting the ability to customize or modify it.

Vehicle Loan

A car loan is a personal loan, used to purchase a new or used vehicle. Repayments are over a fixed term, typically spanning one to seven years. Secured car loans utilize the purchased vehicle as collateral, enabling lower interest rates. In contrast, unsecured loans don’t necessitate vehicle collateral but incur higher interest rates and lower borrowing limits, primarily suitable for used car purchases.

Pros:

• Upon loan repayment, you obtain full ownership

• Vary the loan duration to meet your financial capabilities

• A wide range of lenders and options

Cons:

• A secured loan means the vehicle can be repossessed if payments are not made on time

• Interest rates for car loans can vary significantly, making finding the right lender crucial

Finding the right lender can be a needle in a haystack,

unless you know what you're looking for. That's where we come in.

QE Loans on the Sunshine Coast and in Mackay do all the hard work for you, applying expert knowledge to find the lender who best suits your unique circumstances. We even manage the application for you. Our goal is to save you both time and money.